Who Is Tennis Star Jack Draper’s Girlfriend?

Jack Draper, a 22-year-old British tennis player, has been making waves in the sport. Hailing from L

Huge Charlotte Tilbury summer sale saves shoppers £60 on new ‘magic’ cream

Charlotte Tilbury is offering up to 40% off on its iconic makeup products, including the Magic Water

SOS! Alice Jones had just five days to find a new wedding dress

The article tells the story of a couple, Rupert and the author, who met in 2013 and got engaged in a

Oasys Scores Partnership With Edia to Introduce Retro Video Games to Web3

Oasys, a gaming-focused blockchain, has partnered with Edia, a major IP holder for iconic video game

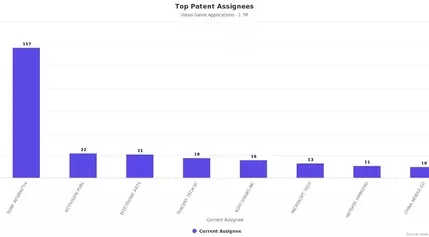

Sony leads game industry in patent filings

The article discusses the patent filing activities of global gaming giants, particularly Sony Intera

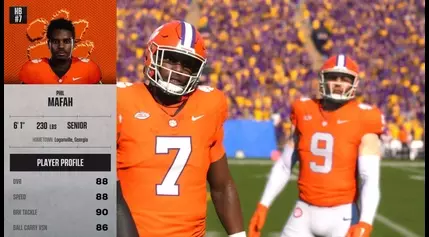

10 Things I Learned About EA College Football 25 In The First 48 Hours

The article provides a detailed review of EA College Football 25, praising its stunning visuals, fas

Star Wars: Galaxy of Heroes is entering Early Access on PC

EA is launching the PC version of its popular mobile game Star Wars: Galaxy of Heroes into Early Acc

CT woman killed after car crash in Enfield

A tragic car crash in Enfield, Connecticut has resulted in the death of a 62-year-old woman and inju

Game wardens investigating alligator poaching in Choctaw County

Game wardens in Oklahoma are investigating the discovery of a poached alligator in southern Choctaw

Detectives say father ignited home with wife, kids inside

The article describes a suspicious house fire in Sarasota, Florida, where the Bureau of Fire, Arson

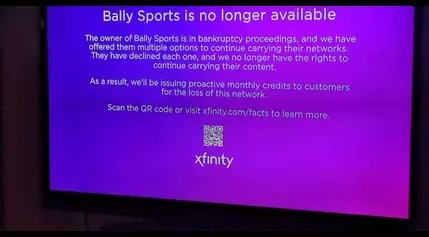

Scoggins: Twins television blackouts depriving fans of a vital part of summertime

The article discusses the frustration of Twins fans due to the TV blackout of Twins games caused by

Kate Hudson and her son Ryder share rare photo at fashion show in Italy

Kate Hudson and her 20-year-old son, Ryder Robinson, made a rare public appearance together at the M

‘Dandy’ Pharrell Williams kicks off Paris Fashion Week for Vuitton

The Paris Fashion Week kicked off with a show by Louis Vuitton, featuring a collection that celebrat

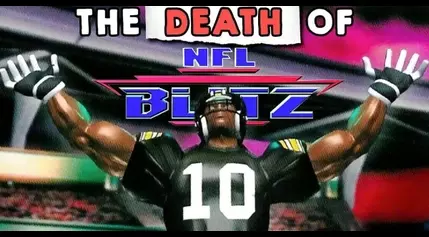

The Real Reason NFL Blitz Could Not Survive

The article provides a weather forecast for Tyler, Texas (75702) on a given day. It predicts showers

New release of video game brings back old memories

The passage reflects the author's fond memories of playing various video games during their college

Celebrity kids & weight loss meds! Shocking truth!

The article provides guidelines for maintaining a respectful and constructive online discussion. It

Katy Perry claims widely-criticised ‘Woman’s World’ music video was “satire”

Katy Perry has responded to criticism of the music video for her new single 'Woman's World', stating

Las Vegas Strip casino to give .6 million from games before closing

The Mirage resort and casino in Las Vegas is closing next week and transitioning to a Hard Rock guit

Watch Little League Baseball World Series championship game, 3rd place streaming free today: Updated bracket (8/25/2024)

The 2024 Little League Baseball World Series championship game is set to take place today, August 25

Target has bigger plans for food and beverages

Target's food and beverage business has seen significant growth, now representing 23% of its total s